OFX Review

I have used OFX for 16 years and after using much of their competition, I believe OFX is number one for most people when it comes to large transfers to and from most countries including US, Europe, UK, Australia, Canada, Hong Kong, Singapore and New Zealand. Best of all, I will show you how you can benefit from OFXs strengths and when an alternative might be better.

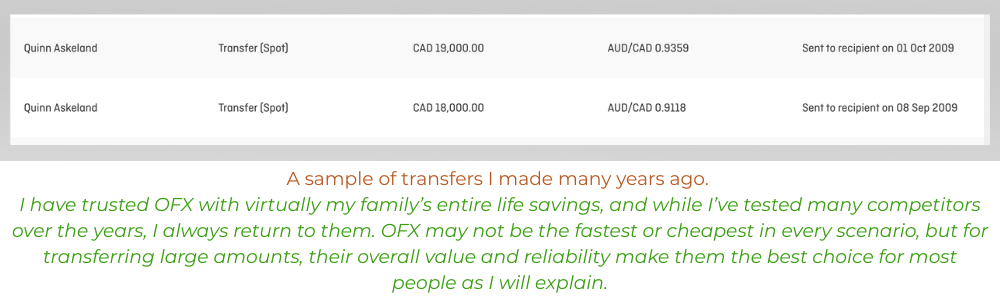

I have used OFX for 16 years and after using much of their competition, I believe OFX is number one for most people when it comes to large transfers to and from most countries including US, Europe, UK, Australia, Canada, Hong Kong, Singapore and New Zealand. Best of all, I will show you how you can benefit from OFXs strengths and when an alternative might be better.

Launched in 1998, OFX didn’t just join the industry—they disrupted it. As one of the original online money transfer pioneers, they started saving customers thousands by dismantling the predatory exchange rates and hidden fees charged by traditional banks. Today, their global reach allows them to send money in 50+ currencies to over 170 countries!

Despite their growth, their core mission remains unchanged. That foundational commitment to value and their unique service model is exactly what has kept me using them for 16 years, and what keeps them top of the pile.

In this review, I am going to show you why their unique personalized service is so important and how their fee structures can work in your favour.

Pros

- Great for large transfers with better rates as amounts grow

- 24/7 customer support, including phone assistance

- Zero transfer fees on most transactions over a set threshold

- Available in over 170+ countries and 50+ currencies

Cons

- Not ideal for smaller transfers

- Slower bank-to-bank transfers

Jump Links

1. What Is OFX?

OFX, originally known as OZForex, UKForex, CanadianForex, NZForex, USForex, ClearFX and Tranzfers became a unified global brand in 2015.

As they have grown worldwide, they have developed a strong presence in the US, UK, Canada, Australia which means they are competitive on rates and have great customer service (not outsourced call centers in who knows where).

As a customer for over 16 years, having lived in multiple countries in different time zones this is gold because it means you can call them 24/7 and always get someone whose sole job is to make transfers happen smoothly.

But for small transfers (even though they handily beat the banks) OFX are not always as inexpensive as some of their competitors which focus on doing everything online.

For larger transfers, OFX offers highly competitive rates, and their 24/7 customer support line is a game-changer. I’ve personally experienced firsthand how quickly they resolve issues when something goes wrong, giving me peace of mind during important transactions.

For this reason they are strong for businesses as well as individuals.

They do charge fees on some smaller transfers but (if you use this link they will not charge you). Having said that, I don’t always recommend them for everyone as you will see below.

2. How OFX Works

At each step, you have the option of calling them to aid in the process. They are also likely to call you which I find really helpful in ensuring transfers go to plan.

2.1 Sign Up and Verify Your Account

Registration is free but requires ID verification. This step can take a day or two, so plan ahead for first-time transfers.

2.2 Book a Transfer

Choose your currencies and amount online or on the phone. OFX locks in your rate for a reasonable amount of time, ensuring you can fund the transfer in time.

2.3 Send Your Money to OFX

Use a network of local banks, so you can easily and inexpensively transfer funds to OFX.

2.4 OFX Sends the Money

Once your funds are received, OFX transfers them to your recipient. OFX tracks where your money is online and sends emails to update.

3. When OFX Doesn’t Work

3.1 Small Transfers

OFX has a minimum transfer amount, typically $1,000 USD ( £100 GBP / $250 AUD/CAD) or equivalent. While you can transfer relatively small amounts above these thresholds they are usually not the cheapest but still better than most banks.

Although there are lots of variables, I believe there is a sweet spot where OFX comes into its own which is above $7000 USD/£4000 GBP/€4500 EU/$9500 CAD/AUD. This is partly because the rates they offer are progressively more competitive, but also most importantly because above this amount regulators have tougher rules and as a result there can be more issues. But these problems can easily be resolved by phone if required.

For smaller transactions, services like Wise are not only more cost-effective they are also excellent when it comes to transfer speed and user experience.

Beyond Wise, if you need cash to arrive (Wise is limited to bank-to-bank transfers) it is hard to beat Remitly which is a standout for its leading customer service with paying out in cash.

3.2 Super Fast Transfers

Part of being optimized for larger transfers means OFX tends to focus on moving money safely and efficiently rather than quickly.

Meanwhile other services that deal with smaller transfers, often invest in finding quicker channels through the multitude of payment options many banks offer. Whilst this can introduce additional fees, if practically instantaneous transfers are a requirement for you check out our Wise review to start with.

And once again if you need to send cash then Remitly is a great choice for speed too.

OFX Scorecard: Overall Rating 4.5/5 Stars

I'm giving OFX an overall 4.5 out of 5 star rating for anyone making larger transfers (over $7000 USD which is $10,000 AUD/CAD or about £5500 GBP). Let's break this down into the key aspects: rates and fees, transfer speed, trustworthiness, and usability.

4. OFX Rates and Fees (4.5/5)

The cost of using OFX depends on two factors:

- Exchange Rate Margin:

OFX applies a small margin to the mid-market exchange rate. This is typically between 0.4%–1.5%, much lower than most banks and pretty standard compared to similar services that handle larger amounts.

- Fees:

- $0 fee for transfers over $10,000: Great for large amounts.

- $15 for some smaller transfers: Still cheaper than most banks and you can have that removed anyway using links on this page.

Here’s how OFX compares to other services for a $10,000 EUR to USD transfer:

- OFX: 10,399.00 (margin only, no fee)

- Wise: 10,461.71 USD (48.31 EUR fee)

- Bank: 10,291.54 (poor rate + additional fees)

Why this matters:

If you’re transferring a large amount of money, OFX’s low margins and competitive rates can save you hundreds - or even thousands compared to banks. And remember: The more you send the lower the more you save!

5. OFX Transfer Speeds (4.4/5)

Transfers with OFX typically take 1 – 5 business days:

- 1 – 2 days: Common for major currency pairs like USD, GBP, EUR. (AUD, CAD are more variable in my experience)

- 3 – 5 days: Possible for less frequently traded currencies.

OFX is pretty typical for services that focus on larger transfers. The reality is that they usually only have your money for a very short period of time and it is the banks at either end.

It is worth noting that if you see shorter timeframes in other websites this is usually because many don’t count the time it takes to fund the transfer.

If speed is critical, check out our Wise Vs OFX page for small or same-day transfers.

Why this matters:

Most people think that money transfer companies are completely powerless to improve the speeds of 3rd party banks but the reality is that in most countries banks have many ways to accept funds like ACH, RTP (USA), SEPA (Europe), Faster Payments, BACS (UK), Interac, EFT (Canada) and BPay, PayID (Australia). Some money transfer companies have set it up to use many of the different systems - this can speed up the process and also make it more expensive.

6. OFX Security (4.7/5)

For us it speaks volumes that OFX has been in business for over 25 years, handling billions of dollars in transfers globally. As mentioned earlier they are also regulated by financial authorities in the UK, US – FINCEN, Australia – ASIC: (AFS Licence number 226484), Canada – FINTRAC, and other major countries, ensuring compliance and security in each country is held to a high standard.

OFX also offers two-factor authentication (2FA) which is a big deal for protecting accounts (and surprisingly, many banks still don’t have it). They also say they have identity protection, fraud prevention, cyber security and segregated accounts but to be honest it is their reputation that matters most.

7. OFX Reviews (Good and Bad) 4.3/5

The OFX money transfer service is highly rated at 4.4/5 stars on TrustPilot from over 11,000 reviews with 82% of these 5-star reviews.

One of the main reasons why OFX attracts so many outstanding reviews comes down to their 24/7 customer sevice which is proactive not just reactive.

As an example, I once tried to send money from my bank in Canada to Australia without realising that my Canadian bank had a daily limit. Before I knew there was a problem, they called me and offered a solution to send the money in two separate smaller transfers but keep the exchange rate the same I had originally locked in.

This is not normal service, OFX goes above and beyond to make transfers go smoothly at a time when most companies are going in exactly the opposite direction with cheaper to run chat bots and email.

The Good

The majority of users praise the company for its competitive rates, excellent customer service, and smooth transaction process.

The Bad

The negative reviews for OFX can be grouped into a few key categories:

- Poor customer service

- Delays and complications with compliance

- Security and data concerns

- Unresolved or delayed transfers

This is based on categorizing the majority of one-star reviews.

Despite generally receiving a high average rating of 4.4/5, the one-star reviews highlight some issues.

Interestingly many of these customers may have gotten their issues resolved because in each case it appears that reviewers have been called by OFX.

Compared to banks which usually cannot score more than about 2 out of 5 and even most money transfer companies, OFX is highly ranked.

8. Bottom Line

For any individual or business needing to move relatively large amounts of money across borders, OFX is the gold standard.

Competitive Advantage: Their variable fee structure and the ability to access zero-fee transfers (if you use this link) ensures maximum savings on transfers.

Service: Robust, proactive customer support adds a layer of confidence that most competitors simply cannot match. (There is one or two, but they are usually more expensive and not 24/7)

Bottom Line: I personally use OFX for any transfer over $7,000 USD ($10,000 AUD/CAD or £5,500 GBP), but if I was only to choose one it would be OFX.